We track the opinions and choices of the largest investors on the planet.

At the Lombard Investor Consensus, we specialize in the analysis and interpretation of market sentiment indicators. This expertise enables us to consistently identify high-potential stocks, the same ones that attracts the attention of markets giants like Goldman Sachs, Morgan Stanley or UBS.

-

In practice, we monitor 800+ large listed companies, systematically measuring and interpreting the sentiment and consensus surrounding them.

-

Each week, we identify 2 highly promising stocks from the most active exchanges from the US and Europe (NYSE, Nasdaq Paris, Amsterdam, Zurich, London...) and send them straight to your inbox.

-

For each recommendation, we provide an exact entry date and a predefined price target. So you always know when to buy, and when to sell.

The results? They speak for themselves. Between 2019 and 2025:

-

71% of our suggested targets were reached within a year

-

The average anualized return reached +10,2%

These professional-grade performances, achieved in full transparency, have earned us the trust of highly sophisticated investors since 2019.

But don't take our word for it, form your own opinion by reviewing our detailed track record:

Why Trust us?

Consensus-Based Methodology

We rely exclusively on market sentiment and consensus indicators to identify promising companies. Our own opinions about a stock play no role in our editorial policy.

Strong Diversification

By covering over 800 stocks across US and European markets in every industry, we enable robust diversification - sectoral as well as geographical.

Excellent (and proven) Results

Between 2019 and 2025, our 200+ published recommendations delivered an average annual return of +10.2%. We publish those results openly, you can review every detail on our Track Record page.

Our Approach

Our expertise lies in the measure and interpetation of sentiment and consensus indicators, an approach that offers distinct advantages over traditional financial analysis.

While a classic approach often reflects the view of a single analyst, sentiment analysis captures the collective outlook of the market, capitalizing on dozens of expert forecasts and opinions.

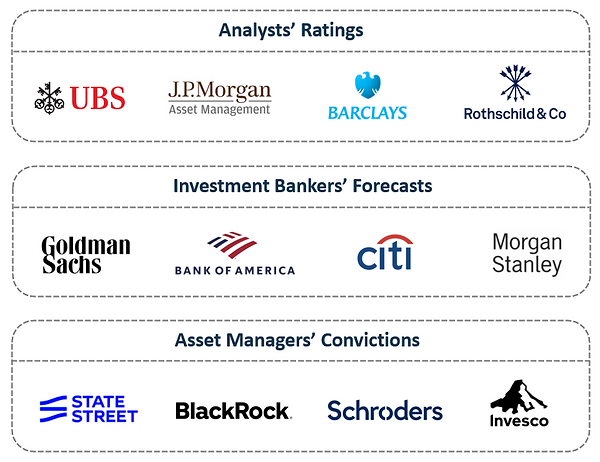

To build your portfolio, why settle for a single analyst’s outlook, when you can benefit from the collective opinions from dozens of sources like:

-

Investment Banks (like Goldman Sachs, Morgan Stanley or HSBC)

-

Asset Managers (think of Allianz, Amundi or UBS)

-

Retail investors' insights (gathered from the most reliable sources)

Frequent Questions

Who are your readers?

Since 2019, our ability to deliver high-quality recommendations with clarity has made us a trusted resource for sophisticated cliens, ranging from individual investors and finance professionals to advisors and Family Offices.

Which exchanges are you monitoring?

We continuously measure consensus and sentiment metrics on 800+ stocks, listed on major US and European exchanges including the NYSE, the Nasdaq, Paris, Amsterdam, Zurich, Frankfurt, London, Brussels and Madrid.

On what format will I receive your research?

Directly by email, in clear and concise PDF format designed to be legible on all screen formats (yes, even on your phone).

Do you follow up on all stocks you recommend?

Absolutely. For each stock we identify, we follow up in all transparency, checking if the price target has been reached or if it ended up in a loss (which happens too, of course).